Contents:

There are many reasons to outsource your bookkeeping, which can be a good option for many companies. Outsourcing your books will free up time to focus on other business aspects. Hiring an experienced company familiar with various bookkeeping services can save you money. Bookkeeping is bookkeeping, irrespective of whether your firm gets bookkeeping tasks done from in-house resources or offshore bookkeepers who work remotely for your firm. Bookkeeping outsourcing is the process of sending traditional bookkeeping tasks such as maintaining financial records to an outsourced bookkeeping staff. This is a more convenient, cost-effective, and time-saving option wherein you can quickly scale your bookkeeping staff without worrying about talent shortages or not being able to attract the right talent.

Outsourcing your bookkeeping can open the door to several benefits that could help you grow your business. First, outsourcing allows you to focus on the things that matter most to your business, such as sales and marketing while saving time and money on other parts of the company. This benefits you now and positions you well for future growth because it frees up resources needed to expand into new markets or launch additional products or services.

We can take care of this process for you with precision and accuracy. With a careful touch, TEAM LUXA will help you navigate your books and gently bring them into compliance. The difference of time zone plays an important role when you avail the services of a company which is located at an offshore location. Therefore, you can ask for financial advice to understand the value of impartial suggestions when dealing with finances and get a complete guideline, when you need it the most. As a business owner, you must have focus on adding value to the expectations of the clients.

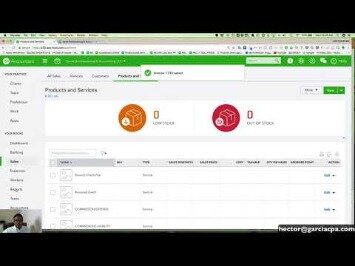

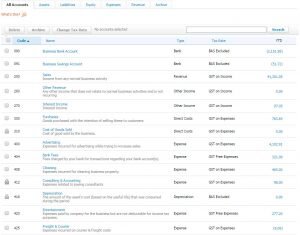

Accounting Software Optimization

Companies which are reliable and offer outsourcing services from an offshore location, have the best resources at their disposal. It is good to remember that the money spent on business is worth its value which is lowered, when you have a team of in-house accountants serving your company with no good contribution in the purview. A business has its foundation built on the services that are rendered by a team of efficient workers. However, it might not be possible to deliver the best when it comes to the best services and the tasks are handled by them. With a steady stream of resources that are deployed by the outsourcing company, you can assign other tasks to your in-house team to maximize the level of productivity.

We already mentioned that outsourcing your bookkeeping is cost-effective. When you outsource your bookkeeping you can rest assured that you’ll have all of the correct information to provide to an accountant or EA. With all of this talk about finances and financial reporting, taxes come to mind. Accounting uses the information your bookkeeper has gathered for you to determine the health of your business. An accountant will review the reports that a bookkeeper provides to help you make important financial decisions.

As an example, maybe a client needs to see a certain report every Monday with updated financial information in order to run their business. On the other hand, a different client may just want to see a monthly P&L and balance sheet. We have helped hundreds of businesses get and stay on track so they are better able to reach their goals. Here are the highlights of how our outsourced bookkeeping services work. Outsource to the accounting experts and you won’t have to worry about compliance with regulatory requirements. This is one of the more important benefits of outsource bookkeeping services considering the penalties for violating government rules and regulations.

Although your https://bookkeeping-reviews.com/ may have an excellent in-house bookkeeping team, there is no guarantee that they will stay for long. Thus, it is preferable to rely on outsourcing bookkeeping companies that provide qualified staff ready to take on complex accounting work. Is it to prepare the end of the month reports, balance sheet, payroll services, tax compliance, or taking care of your account payables and receivables? You may need someone to prepare your bank reconciliations and analysis or just enter the data into the accounting software?

Controlling your business

By giving us essential information such as budget, expenses, liabilities, and upcoming goals, our accounting staff can map out a realistic financial plan for your business. When hiring new staff, you have to train your worker on complex accounting and bookkeeping practices, the industry requirements, or complicated programs. A professional team of accounting bookkeeping services may solve all of these issues. One of the most obvious benefits of outsourcing accounting bookkeeping services is that you save on payroll and operational costs. When you partner with a reputable outsourced accounting services provider, your business will have access to the best, vetted bookkeeping and accounting technology with built-in ongoing user support. Small and medium-sized businesses and nonprofits often cannot afford to hire a full-time department of in-house bookkeepers, controllers, accountants and a CFO.

Financial reports accurately and on time, then you risk keeping your business under poor financial management. These errors not only incur hefty fines and penalties, they can also damage your business’s reputation and put your insurance and licensing at risk. Even if you hire the most trusted and experienced individual to handle your bookkeeping and accounting in-house, your business is still at risk of human error. Choosing a bookkeeping and accounting service for your business depends on which can support the needs of your business the most. Outsourcing your bookkeeping and accounting can help alleviate late, inaccurate or meaningless financial reporting.

Complete Range of Outsourced Bookkeeping and Accounting Experts For Your Company

Invensis’ auditing and taxation services assisted us in effecting significant changes in the business’s focus and nature. They have always provided us with a comprehensive and top-rated service, allowing us to meet deadlines internally and externally. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Infact even CPAs income statement template for excel bookkeeping services to third party companies like us, so they can focus on increasing their business. You’ll want to answer several important questions to determine if your company is best suited to hire bookkeeping and accounting services internally or outsource to a qualified partner. From providing day-to-day outsourcedbookkeeping servicesto higher-levelcontroller servicesincluding financial analysis and planning, our goal is tohelp your business succeed.

Outsourced accounting is a service which provides a full, accounting department experience for small businesses. An accounting department handles the day-to-day transaction coding, accounts payable, accounts receivable, payroll, management financial reporting and many other services. Virtual, outsourced, and online are often used interchangeably when referring to bookkeeping and accounting. However, a virtual bookkeeper or virtual accountantcan sometimes refer to accountants or CPAs who work out of their homes and contract out their services individually.

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

Your business won’t pay overhead costs when using an outsourced service. Outsourced bookkeeping and Controller services cost between $2,500 – $5,000 a month for small and medium businesses depending on the services you require. Even at the top of the range, at $5,000 per month, it would cost your business $60,000 a year, which is substantially less than a bookkeeper and accountant.

A key to a successful business is to keep track of the numbers to see what parts of the business are working and what needs improvement. Supporting Strategies ensures all transactions are accurately captured in the books. In our month-end close and review process, we make necessary journal entry adjustments, reconcile balance sheet accounts and verify accuracy of income statements. We also support additional categorization, such as class or project accounting. A key part of your business is receiving timely payment for your products and services. Supporting Strategies can help you with customer invoicing, as well as with streamlining your collections processes to ensure for strong cash flow.

You get real-time access to your clients’ data with no time or location constraints. Let’s check out how outsourcing bookkeeping services can help your firm save money. Headed by CPAs, Velan has a team of accountants with strong accounting principles to offer bookkeeping and accounting services for CPAs, Firms and individuals.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-all.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

There is no sense paying exorbitant salaries to full-time in-house accountants when you can upsize or downsize accounting needs as needed. This way, if you lose a client or if business slows for another reason, you will not have to pay unemployment claims or find “busy work” for in-house accountants. We have been playing a critical role as an outsource bookkeeping services provider to many small and medium-size business in USA, UK, Canada, Australia, and New Zealand. Our experts are well versed with major accounting solution like Xero, Zoho Books, Quick Books, MYOB, Wave, SAASU,Tally, NETSUITE, Sage and Odoo. Meru Accounting is a technically advanced accounting firm providing you transparent reporting of your outsourced work.

Running a bookkeeping department is tedious and time-consuming, but so crucial to the success of your business. Oftentimes it takes priority over other work or some tasks just don’t get done. Imagine the positive impact of alleviating those tasks for you and your team.

A business may need to scale accounting functions up or down as needed. Review financials, both technical and conceptual, to ensure quality. Post daily transactions including entry of all bank, credit card, or other transactions. Monitor performance & quality for continual improvement of service. We work together to set up systems, establish processes and clean up existing boks.

A business does not survive on mere ideas and opinions that help in saving money. Rather it is more viable to follow those ideas that cater to the essence of business. While a lot of people are of the opinion that outsourcing robs you of the control that you have over different affairs of your business, outsourcing increases your productivity by two folds. The infrastructure of a business plays an important role in its functioning which is reason enough for companies to take a serious approach as far as expansion of the business operation is concerned. Often, entrepreneurs get extremely tensed when they notice any discrepancy in their bank account records and book of accounts. Financial obligations don’t rest—whether they’re yours or your customers’.

GI Outsourcing announces Corporate Training and Development Partnership with AICPA & CIMA – Business Standard

GI Outsourcing announces Corporate Training and Development Partnership with AICPA & CIMA.

Posted: Mon, 27 Feb 2023 12:35:03 GMT [source]

Many bookkeepers work successfully for years without the need for certification. Your small business will see a return on investment in many areas. But one of the most important is reducing the strain and stress on your already tight resources. When you and/or your bookkeeper are under heavy pressure, you are prone to making costly mistakes. Understanding all aspects of your business is part of being an entrepreneur. In the early stages, you have to get comfortable with every department.

Leave a Reply